- Uplifter Knowledge Base

- Administrators (NSO, PSO, Club, Event)

- Financial tools management

-

Registrants / Members

-

Administrators (NSO, PSO, Club, Event)

- ADD-ON FEATURES

- Administrative Dashboard Overview

- Accounts / Profiles management

- Certification Tracking Management for coaches/officials (NSO / PSO)

- Donation campaigns management

- Financial tools management

- Horse Management

- Memberships management (NSO / PSO)

- Permit applications management (Club sanctioning, Event permitting)

- Registration processes creation and setup tools

- Registrations management (Club, Event)

- Reports Management

- Stores & products management (Club, Event)

- 2M

- CCN

- GYMREG

- H2O-REG

- HORSEREG

- ICEREG

- PLAYERWEB

- SNOWREG

- SOCCERREG

- US State Youth Cycling League / Association

- ATHLETICSREG

- Email Management

- SKATEREG

- CURLINGREG

- Information

-

INTERPODIA ADMIN ONLY

Processing fee calculation explanation

Would you like to know the breakdown of the price your registrants will be paying? This article is for you!

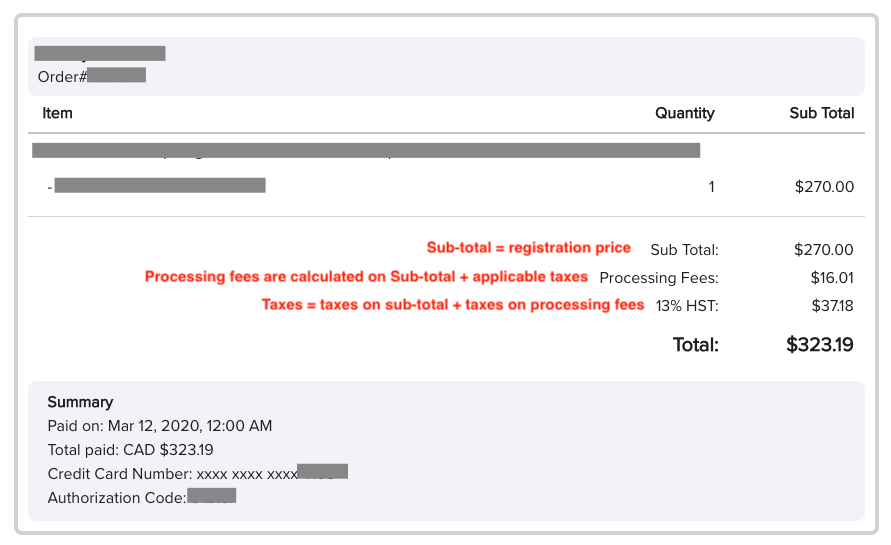

Here is how you can read a transaction receipt:

The processing fees are calculated on the sub-total + your provincial taxes on the subtotal price.

The processing fees rate is based on your contract agreement. For the above exemple, the processing fees are (5% + $0.75 per registration) That's why:

Taxes on sub total price : $270 * 0.13 = $35.1 taxes on sub total

Processing fees on price w/ taxes : $305.1 * 0.05 + $0.75 = $16.01 processing fees

Taxes on processing fees: $16.01 * 0.13 = $2.08 taxes on processing fees

Total taxes : $16.01 + $ 2.08 = $37.18 total taxe